Canadian wage growth has been unusually high, but looks more modest when measured against surging inflation and relative to acute labour shortages earlier in the pandemic recovery, says a new report by RBC Economics.

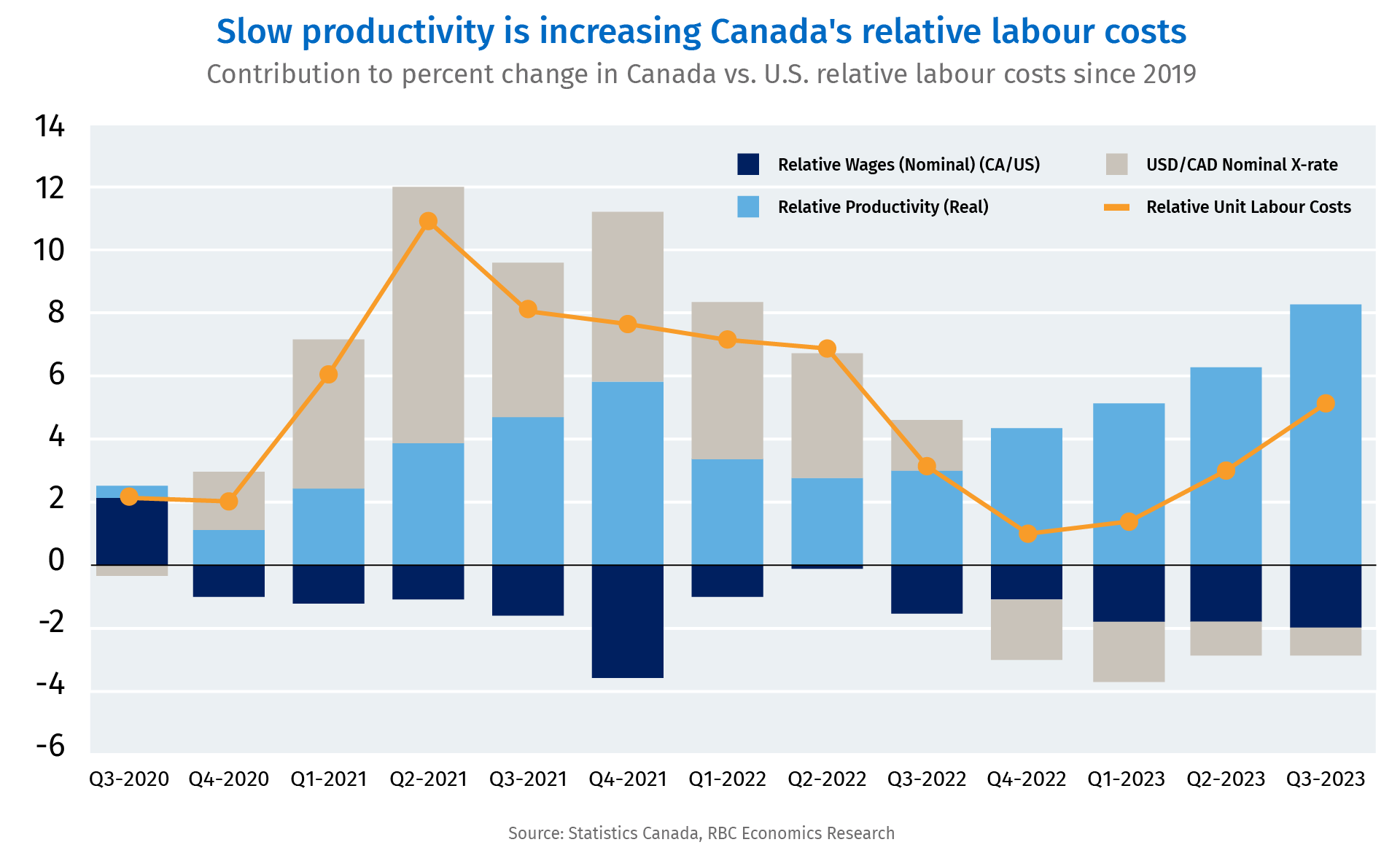

Now lagging productivity in Canada (along with a softening labour market backdrop) are threatening future wage gains. Canada’s weak productivity growth has gotten worse since the pandemic, increasing unit labour costs without the same rise in wages—and strength in U.S. productivity is cutting further into Canadian wage competitiveness, added the report.

“A further deterioration in Canada’s weak productivity performance since the pandemic is threatening the sustainability of wage growth, which has already been relatively modest when measured against surging inflation, ” said RBC.

FULL REPORT

Wages are just now catching up with inflation

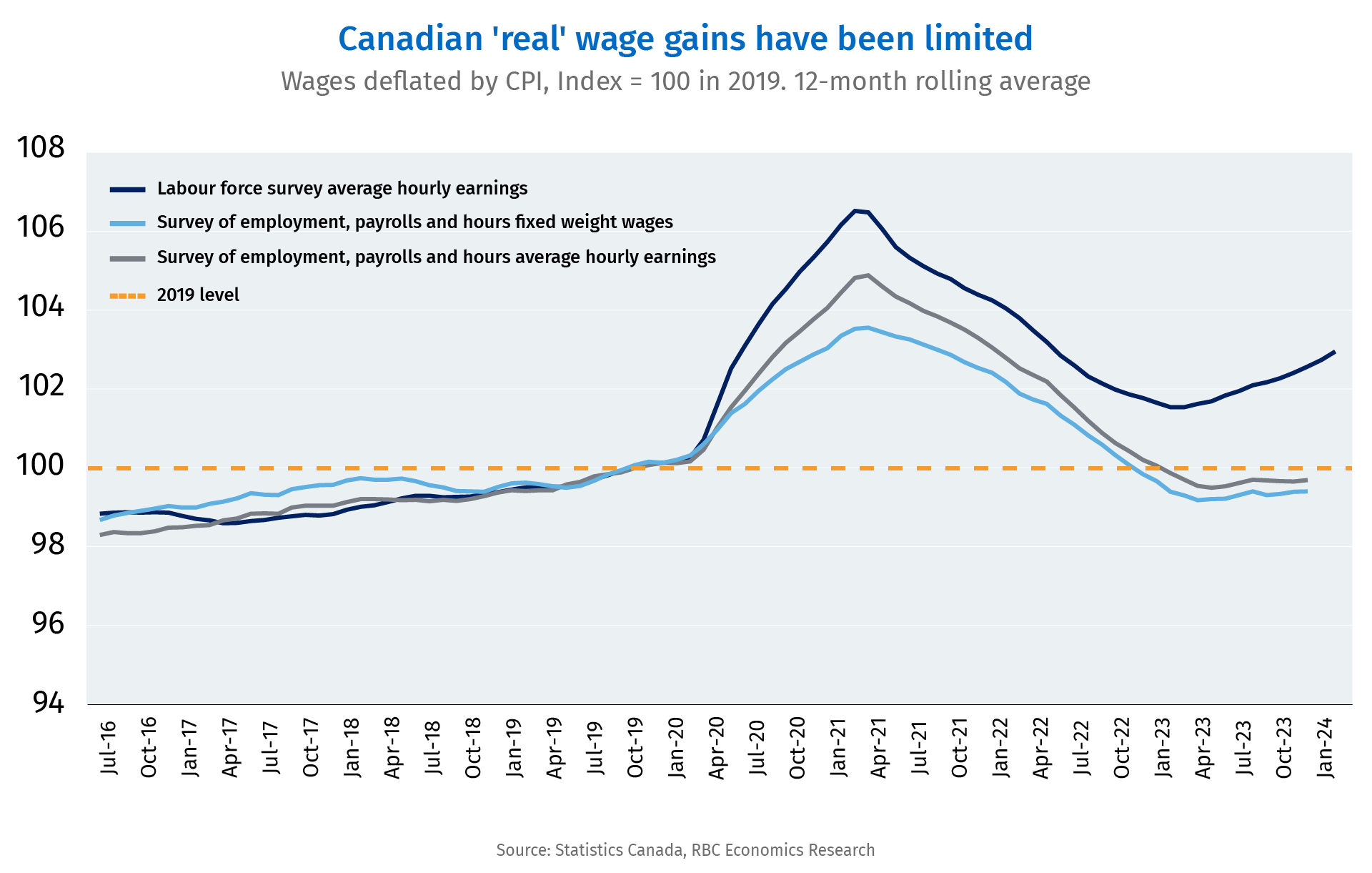

Average wages in Canada jumped higher during the pandemic, almost entirely because job losses were heavily concentrated at the low end of the earnings scale. When workers started to emerge from lockdowns, and inflation began to surge higher in 2021, wage growth lagged, cutting into household purchasing power. There are multiple different, and sometimes conflicting, estimates of average hourly earnings in Canada, and wage growth recently has been substantially stronger. But “real” (after adjusted for inflation) wages declined by about 1% in 2021 and 2.5% in 2022 before picking up in 2023.

Over the full cycle from pre-pandemic (2019) levels to now, estimates for average real wage growth per year range from an optimistic end of about 1%—not significantly different than typical pre-pandemic growth rates—to real wages running still slightly below pre-pandemic levels on the pessimistic side.

That real wage growth looks more modest when measured against the exceptionally tight labour markets early in the pandemic recovery when hiring demand was substantially outpacing the supply of unemployed workers and workers were in a historically strong bargaining position in wage negotiations.

Weak productivity growth threatens future gains

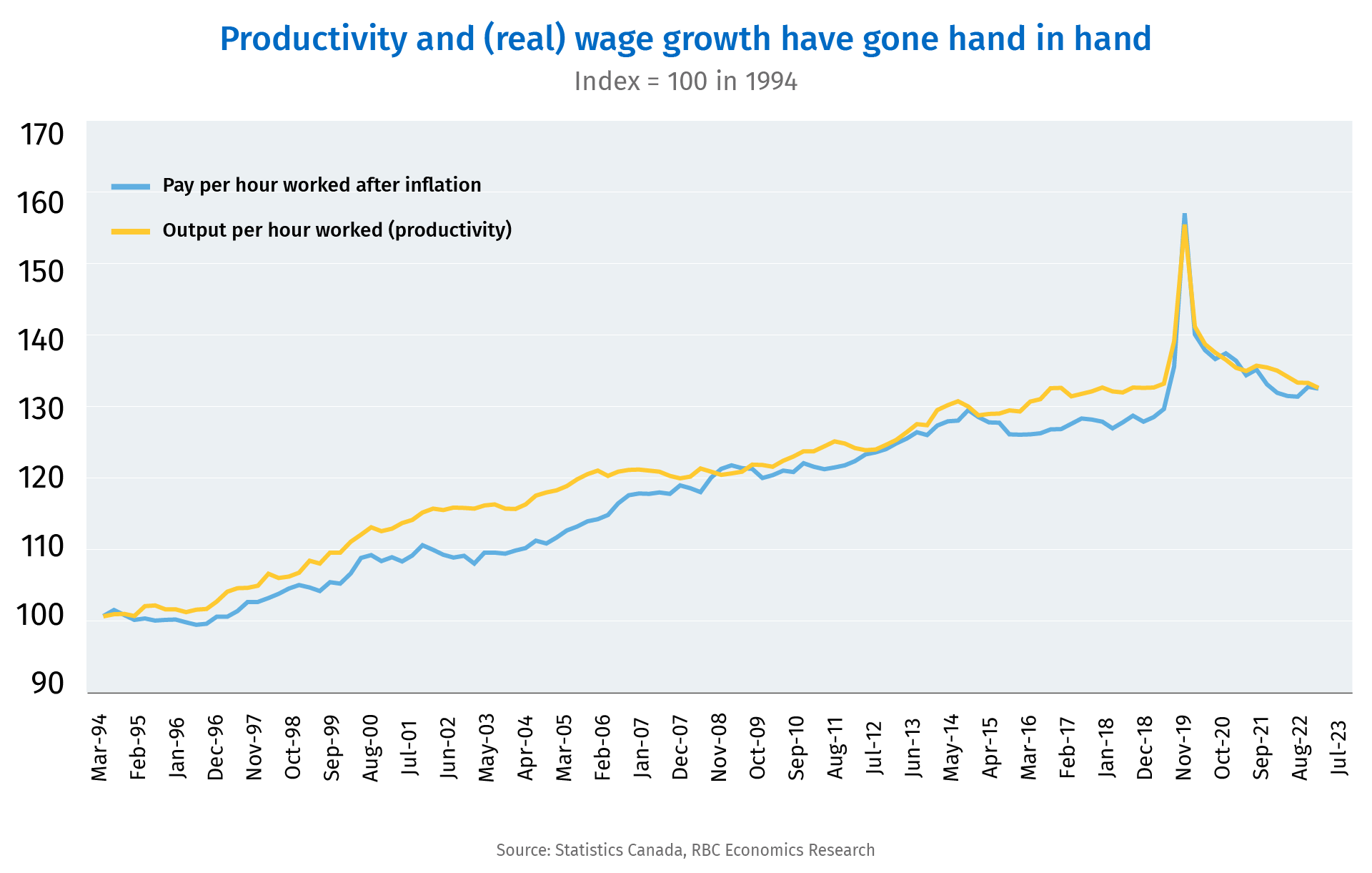

Worker productivity (output per hour worked) is inextricably linked to worker pay over time, and Canadian productivity estimates have been among the more worrying statistics in the post-pandemic economy after already underperforming for decades before.

When productivity rises, it means that more output is generated with the same number of hours worked. That boosts profit for businesses but also creates room for wage growth without lowering businesses’ bottom lines. Productivity normally increases over time as businesses innovate, buy new equipment, and workforce skills improve.

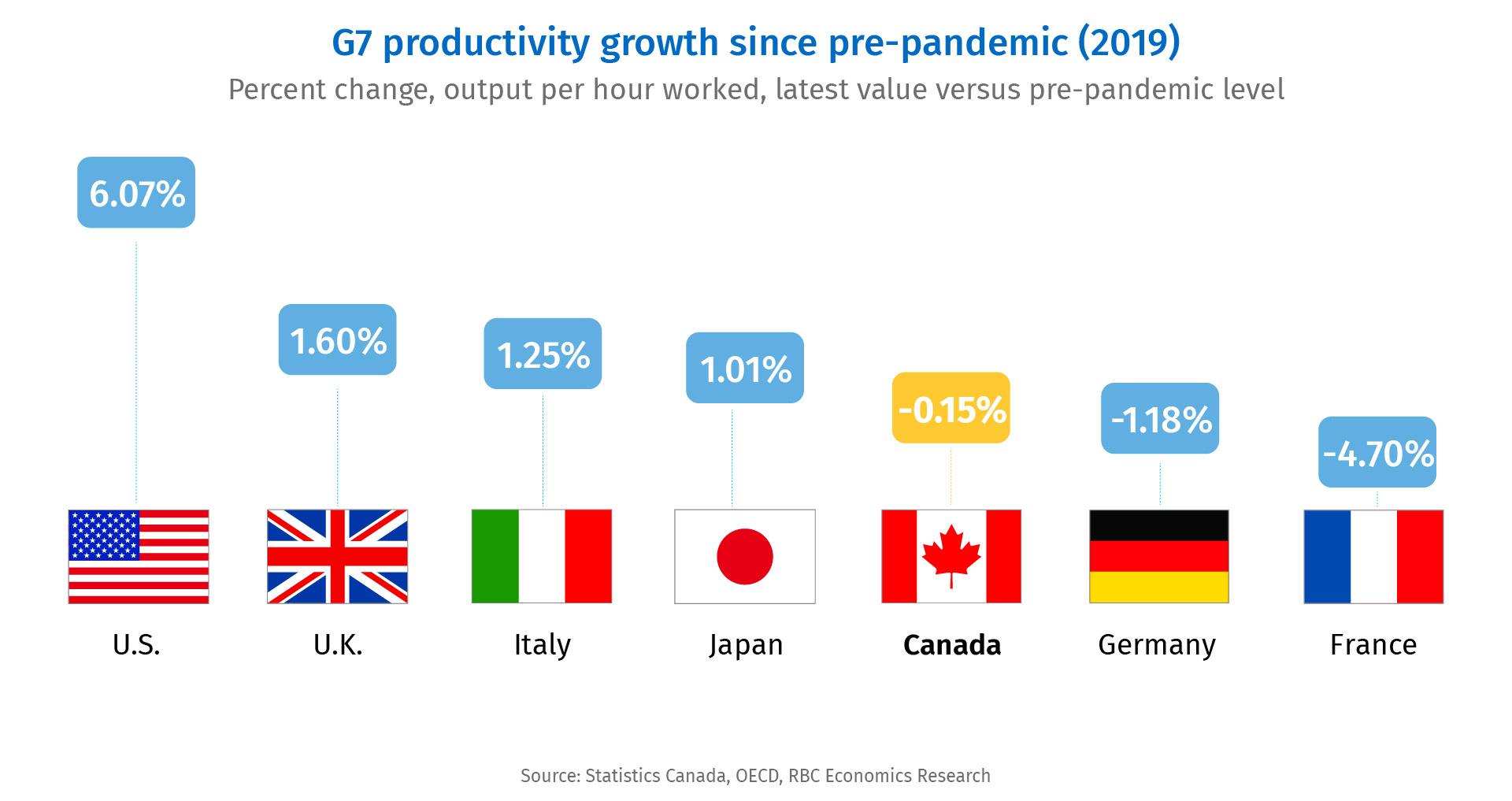

Slow productivity growth is not a new issue for Canada, but has gotten worse since the pandemic. The level of output per hour worked in Canada at last count (Q3 2023) was below average levels four years earlier in 2019. That ranks Canada 5th among G7 economies for productivity growth over that period, and well behind a 6% surge in the United States. More than a decade of low business investment is likely part of the problem but Canada also has a poor track record of fully utilizing the skills of new immigrants.

Near-term fluctuations in supply and demand for labour also have an impact on the distribution of business revenues between owners and workers—and an aging population means labour shortages could persist over the longer run. But sustained growth in wages typically doesn’t happen without sustained increases in worker productivity. Over the last 30 years, real worker pay per hour has moved largely in lockstep with productivity growth.

Wage growth to be uneven but broadly expected to slow

Near-term labour market dynamics have already been shifting the balance of power in wage negotiations away from workers. The availability of workers has increased with the unemployment rate, up 0.7 percentage points from a year ago. Hiring demand is also down sharply with job openings running 25% below year-ago levels. Businesses are reporting less widespread and intense labour shortages. Furthermore, productivity underperformance versus the U.S. has increased relative unit labour costs in Canada by about 5%. That makes Canadian production relatively more expensive and erodes competitiveness.

In the long run, productivity growth is the main driver of improvement in living standards. It’s essentially the only way that business profits and worker wages can sustainably rise at the same time. But, there is little reason to think that productivity growth will substantially accelerate in the near term. Capital investment has remained relatively weak. Productivity growth coming from the service sector—typically less dependent on new machinery and more on human capital (i.e. skills and education)— has also lagged. Output per hour in the professional services sector (historically a relatively high productivity and high wage industry) has declined 10% from pre-pandemic levels, according to Statistics Canada estimates.

There are some obvious solutions to these problems such as encouraging more productivity enhancing business investment and improving the poor track record in Canada of utilizing the skills of new immigrants, for example. However, sustained growth in worker pay significantly above the rate of inflation over the longer run—which is critical to ensuring living standards continue to improve—will also depend on ensuring that the weak productivity performance does not persist.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list. He was also named by RETHINK to its global list of Top Retail Experts 2024.

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 200,000 + audio downloads, 35,000 + average monthly social impressions, 10,000 + engaged social followers and 35,000 newsletter subscribers. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story.