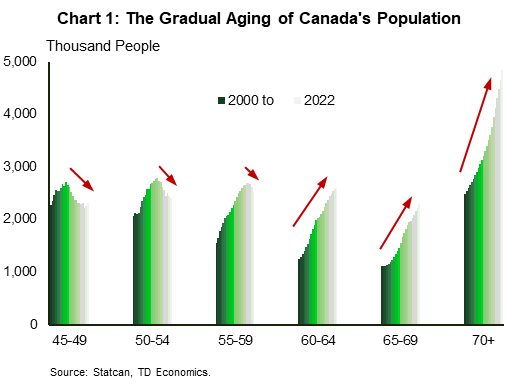

Canada’s aging population will challenge firms’ ability to maintain their workforce. This slow-moving train has been underway for many years, but the willingness and ability for workers to extend their careers has provided an important buffer, says a new report by TD Economics.

“The aging of Canada’s population will be a dominant force in defining the future path of the economy. With each passing year, this slow-moving train intensifies, promising to leave a massive mark on consumer spending patterns, government health care costs, and housing development. But the most acute effect of people leaving their prime earning years and entering retirement will no doubt be on the availability of workers and any resulting skills mismatch to the needs of employers,” said the report.

“The aging of Canada’s population will be a dominant force in defining the future path of the economy. With each passing year, this slow-moving train intensifies, promising to leave a massive mark on consumer spending patterns, government health care costs, and housing development. But the most acute effect of people leaving their prime earning years and entering retirement will no doubt be on the availability of workers and any resulting skills mismatch to the needs of employers,” said the report.

“To be sure, this is already playing out with the boomer generation ranging in age between 58 and 77 years. Our calculations show that this so-called greying effect is likely to accelerate over the next several years, posing a challenge for businesses that must hire and train new workers to take the seats of those who leave. Although high immigration targets will support the ability for the prime working age population (25- to 54-year-olds) to offset the wave of retirees, ensuring that Canada’s labour supply has the skills needed to fill the jobs demanded by businesses will be a defining challenge for the economy.

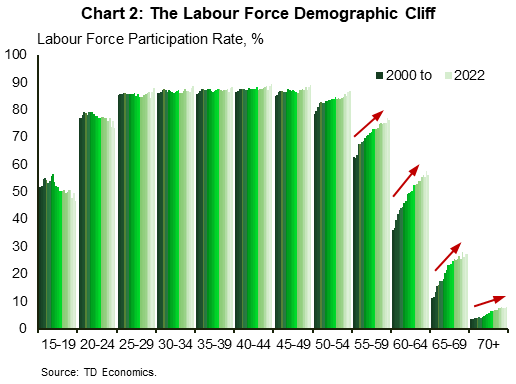

“Luckily for Canada, forces at play in recent years have dampened the impact on labour market participation resulting from this grey wave. As we show in Chart 2, there has been a notable increase in the percentage of people remaining in the labour force in each age cohort from 55 and older. This increase in labour market engagement is likely due to several factors. These include the elimination of the mandatory retirement age in various provinces, the ability to defer Canadian Pension Plan (CPP) benefits, the increase in service sector jobs, and the fact that people are generally healthier today than prior generations of the same age.”

The report said the onset of the pandemic appears to have further boosted labour market participation of the mid-50s and early-60s cohorts. This phenomenon may persist if rising rent and housing costs fuel worries about the adequacy of retirement savings. The decline in financial market assets has also likely put a dent in retirement nest eggs, added the report.

The report said the onset of the pandemic appears to have further boosted labour market participation of the mid-50s and early-60s cohorts. This phenomenon may persist if rising rent and housing costs fuel worries about the adequacy of retirement savings. The decline in financial market assets has also likely put a dent in retirement nest eggs, added the report.

“According to a recent Ipsos study, a third of people planning to retire think they will outlive their savings within 10 years. Furthermore, only half of people surveyed have a financial plan for retirement. Given the rise in the cost of living and volatility in financial markets, there may be both near-term cyclical and longer-term structural reasons for the trend increase in the labour force participation of older age cohorts,” it said.

“For employers, this means that there have been fewer retirement parties than would have otherwise been the case. The number of people choosing to retire from 2000 to 2020 has significantly lagged the increase in people entering retirement age. By our calculations, the willingness of Canadian’s 60 and older to remain in the workforce has resulted in nearly 1.1 million more workers than what would have been the case if participation rates of the early 2000s were kept constant. This runs contrary to what we are seeing stateside, where it is estimated that the pandemic alone has resulted in nearly 3 million excess retirements. For a Canadian economy that still has approximately a million unfilled job vacancies, avoiding a U.S. style retirement boom has been an important buffer for the economy.”

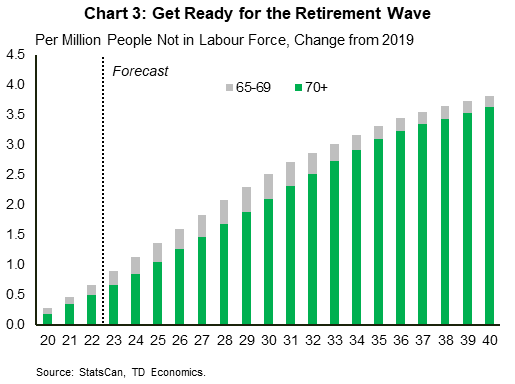

TD said we might be starting to see the pace of retirements accelerate. The Labour Force Survey estimates that 266,000 people retired in the prior 12 months as of December, representing a 17% increase over the prior two years.

TD said we might be starting to see the pace of retirements accelerate. The Labour Force Survey estimates that 266,000 people retired in the prior 12 months as of December, representing a 17% increase over the prior two years.

“We believe this trend is likely to continue. By 2025, we expect to see the number of people 65 and older grow by 1 million. Based on current participation rates, that means nearly 900 thousand workers will leave their jobs in the next three years. That is a 50% increase in the average number of retirees each year compared to the average of the last 10 years,” explained the report.

“This challenge should not be overlooked by any Canadian firm. Though potential retirees may continue to extend their careers and edge up participation rates further, that can only slow and not offset the reality of more and more workers moving into older age cohorts where participation rates decline sharply.”

(Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He worked for 35 years at the Calgary Herald, covering sports, crime, politics, health, faith, city and breaking news, and business. He works as well as a freelance writer for several national publications and as a consultant in communications and media relations/training. Mario was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list)

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience with over 120,000 downloads and thousands of subscribers on all our social channels and YouTube. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story.