High rates of population growth thanks to immigration in Canada have helped to blunt the substantial costs of an aging population even though it’s created other economic challenges, says a report by RBC Economics.

The report said Canada’s non-permanent resident caps are set to curb ballooning population growth. The population will be at least 2.5% smaller in 2027 than it would have been without the restrictions on non-permanent residents.

“But even with the caps in place, Canada’s population will continue to grow. The migration rate is nearly double that of the United States. Immigration has long been viewed as a strategy to slow the pace of population aging since immigrants, on average, are younger than the existing population. Canada’s age-related unfunded liability was sized at $70,000 per person by the C.D. Howe Institute in 2018, significantly smaller than the U.S. at $236,000 on a per-capita basis. Even with immigration caps in place, the hit to Canadian finances from an aging population will be much smaller than in other countries, because of migrants,” it said.

It said Canada’s recent cap on non-permanent residents along with a limit on international study permits is indicative of a broader shift in public attitudes towards immigration. The goal of recent policy measures has been to respond to concerns about Canada’s ballooning population including its impact on housing affordability.

But, reducing immigration also has longer-run economic costs. The Canadian population—like many advanced economies— is getting older. The share of the population that is over age 65 is increasing rapidly as the large baby boom generation flows through to retirement. An aging population means the share of the population that is retired is rising, even though people are working longer than they used to, added RBC.

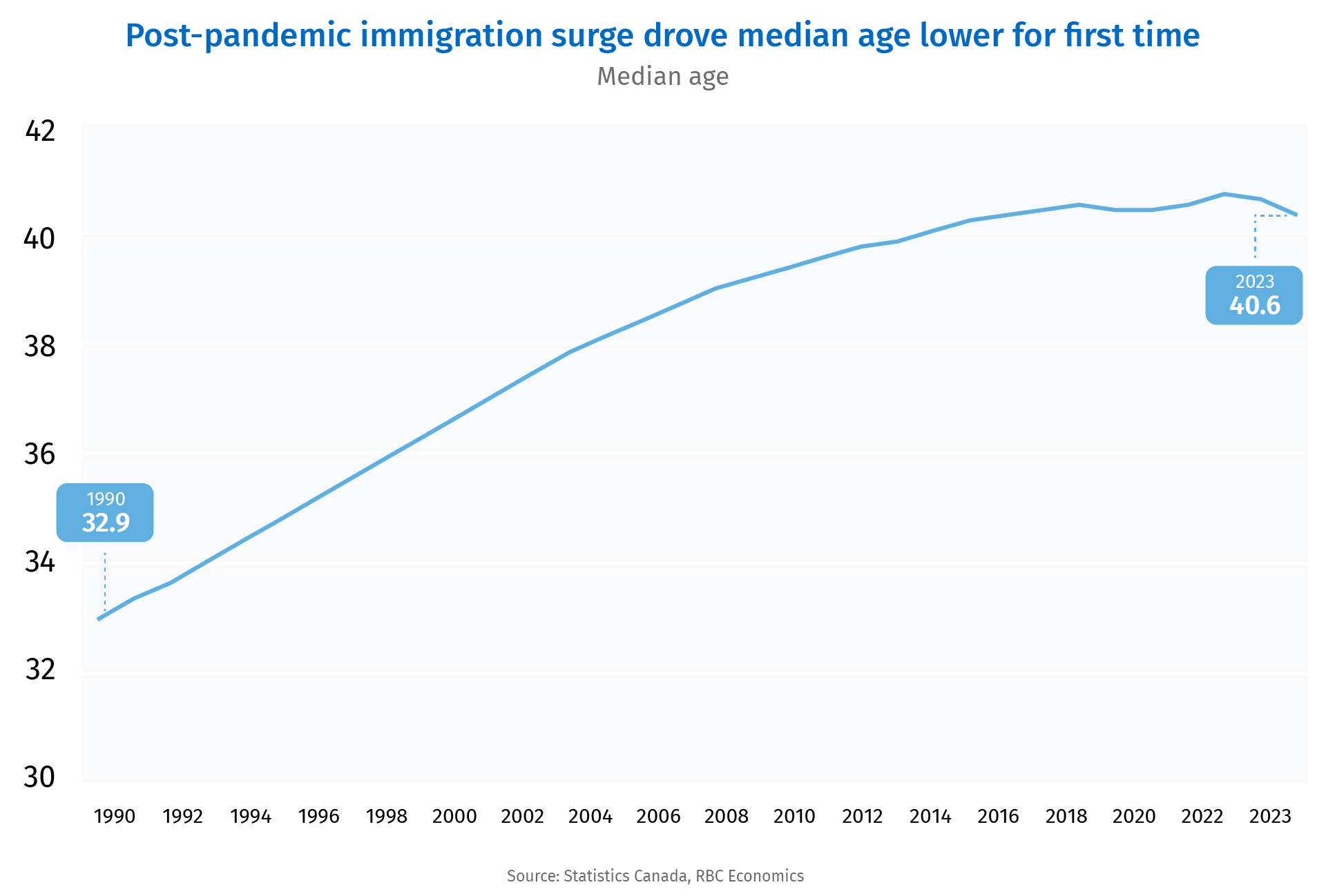

“Immigration helps to bend that population age curve because new immigrants, on average, are younger than the existing Canadian population. The average Canadian is 42 years old, while the average newcomer (either permanent or non-permanent resident) is more than a decade younger at age 28. After the pandemic, a surge in new arrivals drove Canada’s median age lower for two consecutive years in 2022 and 2023 for the first time on record back to 40.6,” added the report.

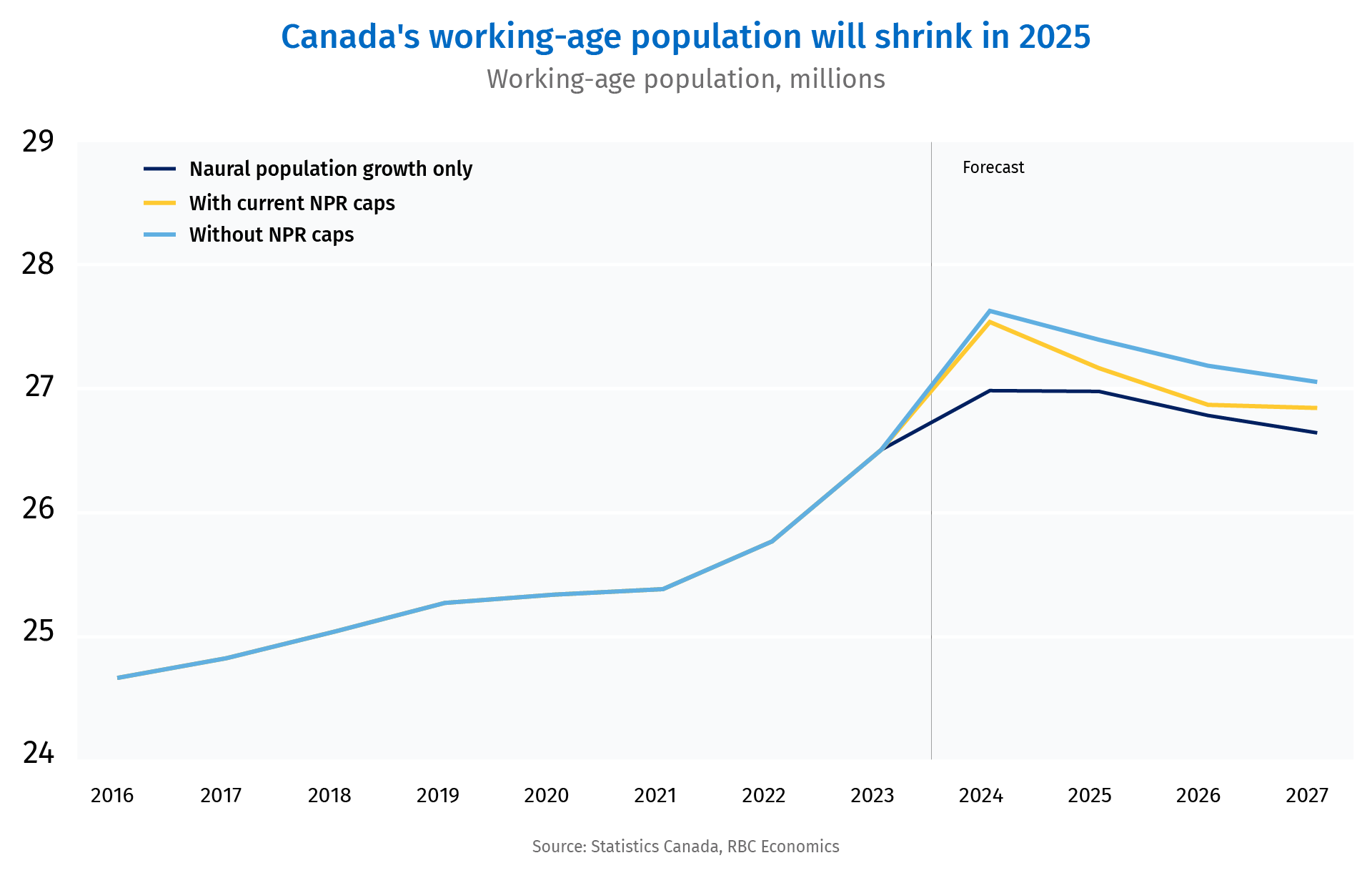

While the new non-permanent resident cap will not put an end to population growth, it will curb its pace and speed up the aging of the population, even if only by a little. Canada’s pace of population growth was already expected to slow to 1.6% between 2025 and 2027 from annual growth above 3% in recent years. The new non-permanent resident cap will slow growth even more to average 0.8% over that time period. That may sound small, but it amounts to nearly 1.1 million fewer people in Canada by 2027. That’s a 2.5% reduction from population growth forecasts before the caps were introduced. The cap will translate to a 0.9% reduction in the size of Canada’s working-age population and boost the dependency ratio to 58.9% by 2027. The ratio—the number of dependents (aged zero to 14 or 65 and older) per 100 working-age people (15 to 64)—is up 0.5% from projections before the caps, according to the report.

“Canada’s immigration growth has been faster than in most advanced economies, but trying to bend the age curve via immigration is not the only possible way to address an aging population. Canada was proactive in the 1990s at pre-emptively increasing Canada Pension Plan contributions and establishing the Canada Pension Plan Investment Board (CPPIB), so that the national pension system is, at least, fully funded,” it said.

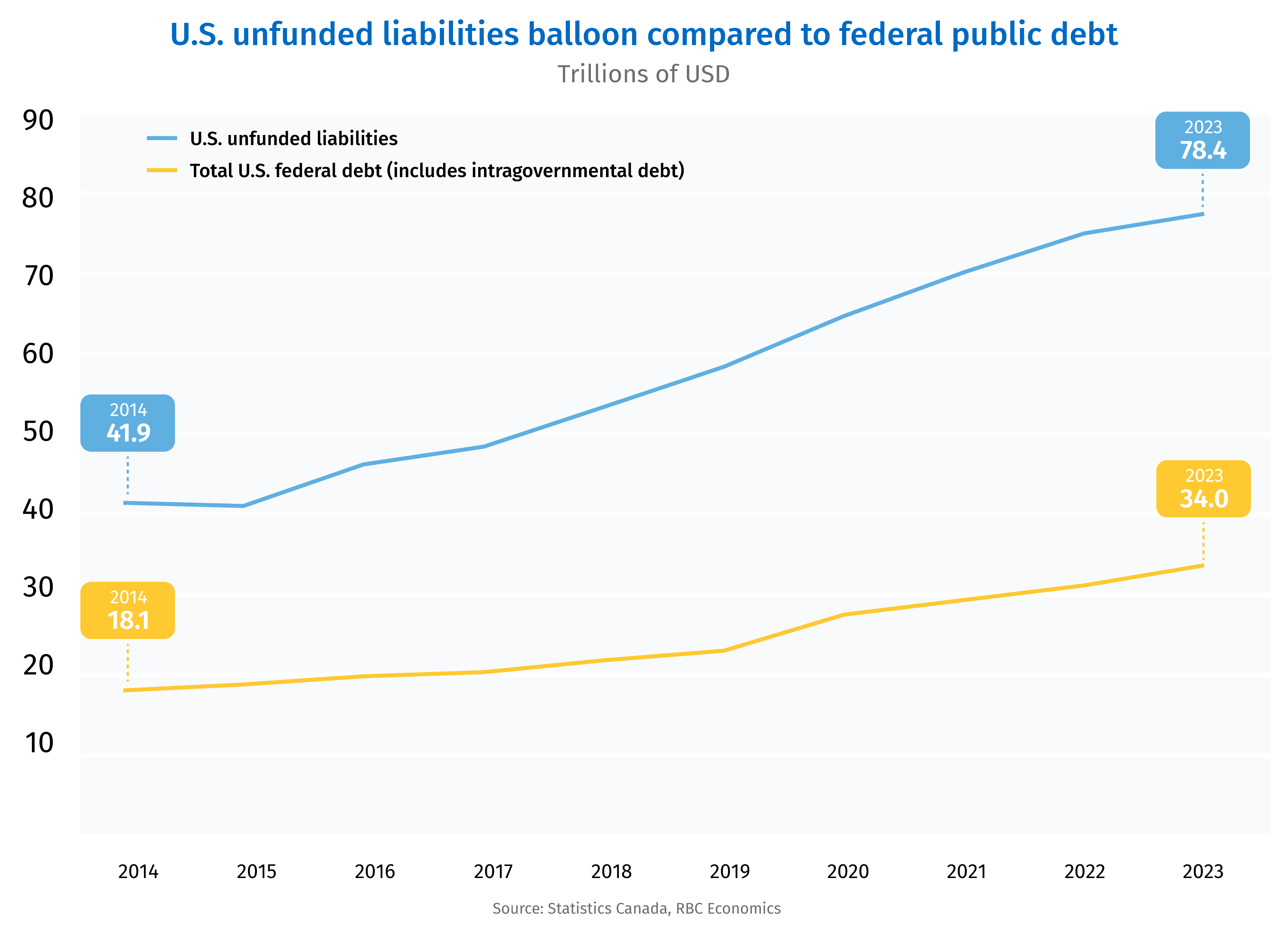

“The reality is that an aging population does create substantial costs for an economy that need to be paid at some point. Not being proactive in getting ahead of that curve is effectively passing on the costs to future taxpayers. The U.S. has not been addressing a long-expected shortfall in its social security program and is also facing dramatically higher healthcare costs as the population ages. These are mandatory U.S. federal government programs—essentially a debt made by the American public that will have to be paid by them,” said RBC.

“The cost is massive. The current value of future U.S. unfunded liability adds up to just under US$80 trillion, or US$236,000 per person. That is nearly three times larger than the current stock of U.S. government debt held by the public (US$26 trillion) and almost three times the size of the economy.

“Canada’s unfunded liability is estimated to be a much smaller fraction—$70,000 per person for healthcare and social assistance, according to a 2018 C.D. Howe report. There are two reasons Canada’s unfunded liability is smaller. First, CPP is fully funded thanks to the introduction of the CPPIB in 1997. Second, Canada continued to ramp up immigration targets, knowing that more newcomers would insulate against a shrinking labour force and its consequences.

“In the coming years, Canada can continue to count on immigration to partially offset the effects of an aging population, including a larger funding gap as the labour force naturally shrinks. Countries that have not been proactively targeting immigration to address these challenges will bear the consequences in the decades ahead.

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list. He was also named by RETHINK to its global list of Top Retail Experts 2024.

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 200,000 + audio downloads, 35,000 + average monthly social impressions, 10,000 + engaged social followers and 35,000 newsletter subscribers. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story