Century 21’s annual price per square foot survey of Canadian homes looks at prices back to 2018 for almost 50 communities. It says prices have held steady in the first half of this year with some exceptions.

PRESS RELEASE

VANCOUVER, British Columbia, July 22, 2024 (GLOBE NEWSWIRE) — Canadian housing prices per square foot generally held steady in the first half of this year, with some notable exceptions indicating families continue to migrate to more affordable communities both nearby and across provincial borders.

CENTURY 21 Canada’s eighth annual Price per Square Foot survey compares the price per square foot of properties sold in almost 50 communities between January 1 and June 30 this year to the same period of previous years. In many cases it has data going back to 2018 for both metro centers and smaller communities.

The report reveals that prices in Ontario, BC, and Atlantic Canada remained largely steady this year, with gains in some smaller markets and suburbs while downtown condo prices declined indicating continued migration away from metro cores. Alberta bucked the trend with significant price increases in a number of markets including Calgary and Edmonton – but to prices per square foot still well below those in BC, Quebec, and Ontario. The Prairies also saw price increases, but at a more modest pace.

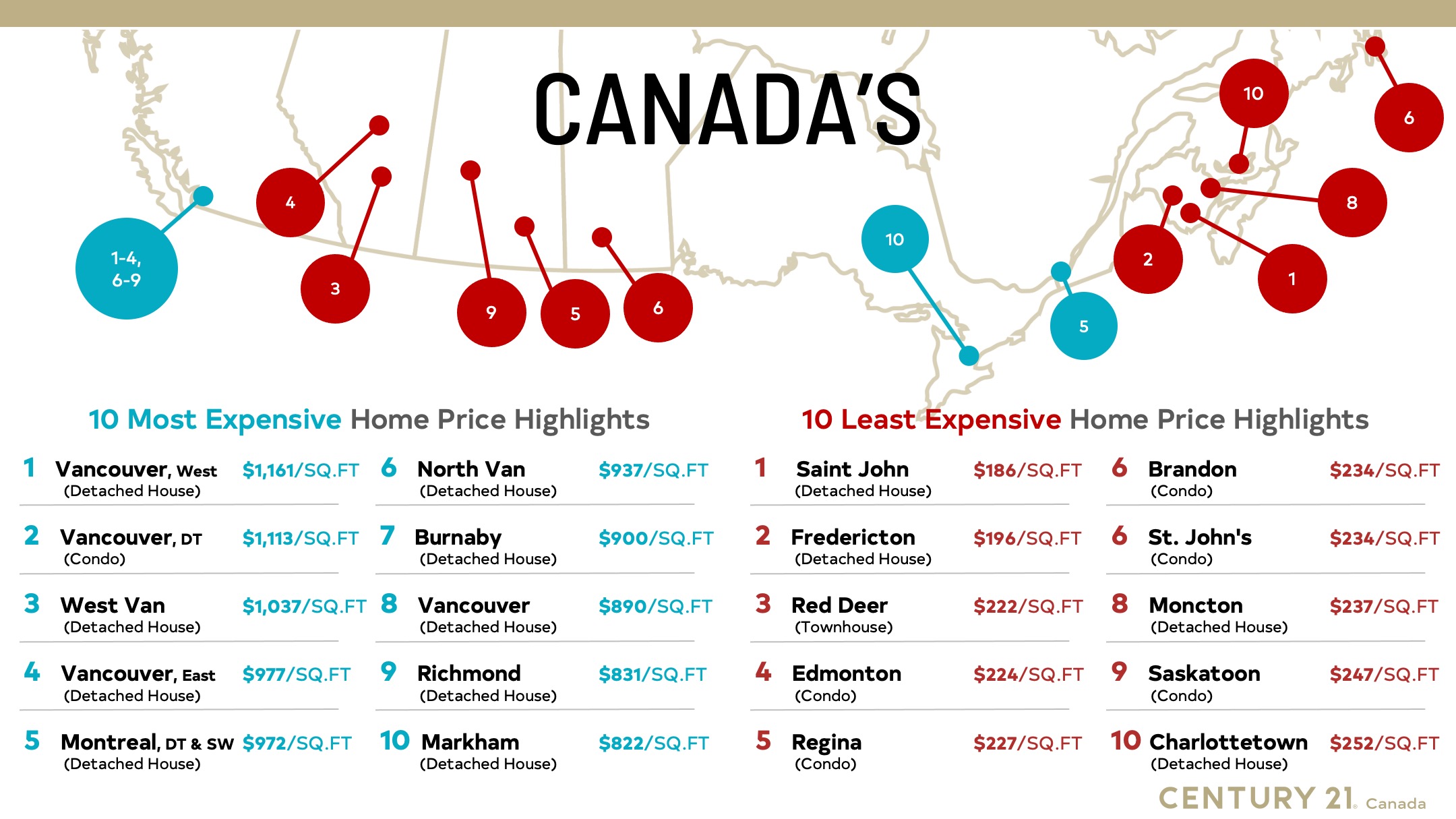

Major city condo markets outside of Alberta all saw modest dips in price per square foot, while those in Alberta rose – by more than 17 per cent in Calgary and almost 10 per cent in Edmonton. Condo prices in High River topped the increases at more than 22 percent, but to a relatively affordable $285 a square foot. That compares to $421 in Calgary (up 17.6 per cent), $1,113 in downtown Vancouver (down 1.7 per cent), $706 in downtown Toronto (down 4.5 per cent), and $672 in downtown Montreal (down 11.9 per cent). Vancouver continues to have the highest prices in Canada, while the Prairies and Atlantic Canada have the most affordable.

Looking back over the history of the survey, even with some declines over the last couple of years pricing has not fallen below 2021 levels in any included market. During COVID, 2021 saw significant price surges and set a new benchmark in markets coast-to-coast. For the most part, prices remain well above pre-COVID average.

Sales volumes across Canada have declined from the brisk market of 2021 and 2022, especially in larger cities.

“A number of our brokers are experiencing a slower market when compared to the conditions of just two years ago,” says Todd Shyiak, Executive Vice President of CENTURY 21 Canada. “While across the Prairies and Atlantic provinces the market is quite active and balanced, increasing inventory and hesitant buyers in the GTA and the Lower Mainland (Vancouver and area) are resulting in a ‘wait and see’ market. With the next possible rate cut coming on July 24 buyers may be extending their ‘wait and see’ approach until the fall.”

Shyiak says that inventory and interest rates will likely be major factors in prices going forward, as sellers may hold off on putting their homes on the market in response to a hesitant buyer base waiting for interest rates to fall.

“Ultimately, we don’t know what the next six months holds for our housing prices, but it’s important not to get too focused on any single year and look at each data point within the larger context of ever-evolving trends. That’s why this survey becomes more valuable year-over-year, because it allows us to see the big picture of Canadian housing.”

Regional highlights:

Atlantic Canada

Prices in Atlantic Canada have continued to see growth, but generally at a far more moderate pace compared to recent years. The sharp rise of Halifax condo prices seen in recent years stopped this year, with no change in price since last year. St. John’s, NL was an exception, with double-digit price growth continuing a steady upward trend that started in 2021. Moncton, NB also bucked this trend with a sharp 20 per cent rise in detached home prices, but to prices per square foot still among the lowest in Canada. Both are smaller market feeling the boost of immigration both from abroad and within Canada. Along with the Prairies, Atlantic Canada continues to be the most affordable region in Canada, per square foot.

“We’re definitely feeling the change in the market, some areas of the region listing inventory is down while in others it is up. Prices are still trending up at various degrees and there are still families looking to make their home here,” says Joel Ives, Broker at CENTURY 21 Colonial Realty in Charlottetown. “I think we’re going to be able to weather these market conditions because we still have the advantage of affordability compared to the bigger markets.”

British Columbia

Though BC prices were stable overall for the first two-quarters of 2024 several Metro Vancouver suburbs saw price increases while Vancouver condo prices fell modestly, anecdotally due to families continuing to migrate from the city core to more affordable markets that offer more space. Vancouver east side houses went up almost 18 per cent in price to $977 per square foot, a rebound from a price decrease last year and well below the price per square foot of west side and downtown properties. West Vancouver, North Vancouver, Burnaby, Richmond, Delta, White Rock/South Surrey all saw increases this year as well – most of them modest, and a rebound from last year’s declines. Fraser Valley prices were stable.

In BC’s interior Kelowna’s market looks to have finally cooled after years of steady growth going back to 2019. Vernon is new to the report this year, with rates somewhat below those in Kelowna.

“A lot stayed the same this year, and it’s preferable to the alternative,” says CENTURY 21 Creekside owner Cameron Van Klei in Chilliwack. “We’re not seeing any signs of a huge turn, but it has been sluggish and we’re seeing the inevitable slowdown from the boom market of 2021.”

Quebec

After several years of sharp increases Montreal condo prices have declined by approximately 11 per cent. Conversely, detached homes have risen by a similar amount, which could tell a story of younger folks looking to upgrade to more space without moving out of the major metro area.

Ontario

Ontario was largely stable across the board, with the exception of a double-digit drop in Windsor detached house prices. That decrease follows a surge last year, returning the community to prices more in line with 2020 – 2022. The GTA saw little change, with the Toronto downtown condo market dipping by roughly 4.5 per cent. This drop builds on a sharp decline last year.

Sault Ste. Marie is new to the survey this year, and has the lowest PPSF for both condos and detached homes in the province. “We’re excited to see where the results of his survey take us,” says CENTURY 21 Choice Realty owner James Caicco in Sault Ste. Marie. “Our community is growing quickly and we’re sure that year-over-year trends will show just how many people have chosen to make Sault Ste. Marie their home.”

Prairies

Overall, prices in the prairies were up in the single digits. Condo prices rose as the larger cities in the region continue to grow, with Regina condos seeing the largest gain at 16 per cent with smaller gains throughout the rest of the province. Only Brandon condos trended downwards, but at a very modest 0.85 per cent. Prairie prices remain among the most affordable in Canada.

Alberta

Alberta bucked the national trend, with prices increasing briskly in numerous markets. Even with the increases Alberta prices remain well below those in neighboring BC, as well as Ontario and Quebec. The price increases tell a story of migration – Canadians moving to Alberta, in particular smaller communities where property prices remain moderate. Calgary prices continues to grow, with young professionals pushing condo prices up 17 per cent from last year.

CENTURY 21 Canada’s annual survey of data on the price per square foot (PPSF) of properties gathers and compares sales data from its franchises across Canada from January 1 to June 30 of each year. By looking at the price per square foot at the same time each year the firm is able to get a good idea of how prices have changed over time for similar properties. This year’s survey compares 2023 prices with this year’s results.

See full PPSF study results here.

About CENTURY 21 Canada®

CENTURY 21 Canada Limited Partnership (century21.ca) is a real estate master franchisor with complete rights to the CENTURY 21® brand in Canada.

The CENTURY 21 System is one of the world’s largest and most recognized residential real estate franchise sales organization with approximately 9,400 independently owned and operated franchised real estate offices worldwide and over 127,000 sales professionals. CENTURY 21 provides comprehensive technology, marketing, training, management, and administrative support for its members in 80 countries and territories worldwide.

How the information was gathered by CENTURY 21 Canada

CENTURY 21 franchisees were asked to help come up with the average price-per-square-foot in their market. Data published by the Canadian Real Estate Association for various MLS boards was also analyzed. However, calculating a precise number is not an exact science as every office and province tracks statistics slightly differently. As a result, most have used the median price and square footage in their market in sales from January 1 – June 30, 2024. Each franchisee has confirmed that that the numbers provided are an accurate representation of the trends market.

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list. He was also named by RETHINK to its global list of Top Retail Experts 2024.

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 200,000 + audio downloads, 35,000 + average monthly social impressions, 10,000 + engaged social followers and 35,000 newsletter subscribers. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story