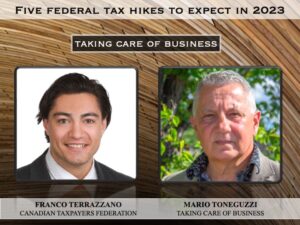

Franco Terrazzano, Federal Director, Canadian Taxpayers Federation, discusses some major tax changes for Canadians in 2023.

Terrazzano talks about the Canada Pension Plan tax, the Employment Insurance tax, the carbon tax, the second carbon tax and the alcohol escalator tax. He also talks about the impact these are having on Canadians and Canadian businesses.

Full video can be seen here.

PRESS RELEASE

OTTAWA, ON: The Canadian Taxpayers Federation released its annual New Year’s Tax Changes report today to highlight the major tax changes in 2023.

OTTAWA, ON: The Canadian Taxpayers Federation released its annual New Year’s Tax Changes report today to highlight the major tax changes in 2023.

“Tax hikes will give Canadians a hangover in the new year,” said Franco Terrazzano, Federal Director of the CTF. “Canadians can’t afford gas or groceries and the government is making things worse by hiking taxes.”

The report outlines the major federal and provincial tax changes slated for 2023. Federal tax hikes include:

Canada Pension Plan tax: Workers making $66,600 or more will pay an extra $255 through the CPP tax in 2023. Their employers will also pay an extra $255.

Employment Insurance tax: Workers making $61,500 or more will pay an extra $50 through the EI tax in 2023. Their employers will pay an extra $70.

In total, payroll taxes will cost a middle-class worker $4,756 in 2023. Their employer will also be forced to pay $5,157. The federal government is raising the basic personal amount for income taxes. However, because of the payroll tax hikes, anyone making $40,000 or more in 2023 will pay higher federal income-based taxes than in 2022.

Carbon tax: The federal carbon tax is increasing to 14 cents per litre of gas beginning April 1, 2023. The carbon tax will cost the average household between $402 and $847 in 2023, even after the rebates, according to the Parliamentary Budget Officer.

Second carbon tax: The federal government is imposing a second carbon tax through fuel regulations on July 1, 2023. The second carbon tax will increase the price of gas by up to 13 cents per litre by 2030. There are no rebates for the second carbon tax.

Alcohol escalator tax: Alcohol taxes will increase by 6.3 per cent on April 1, 2023. Taxes already account for about half of the price of beer, 65 per cent of the price of wine and more than three quarters of the price of spirits.

“Other countries are cutting taxes, but Ottawa is sticking Canadians with higher bills,” said Terrazzano. “Prime Minister Justin Trudeau needs to stop wasting so much money and cut taxes.”

You can read the CTF’s New Year’s Tax Changes report here.

(Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He worked for 35 years at the Calgary Herald, covering sports, crime, politics, health, faith, city and breaking news, and business. He works as well as a freelance writer for several national publications and as a consultant in communications and media relations/training. Mario was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list)

(Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He worked for 35 years at the Calgary Herald, covering sports, crime, politics, health, faith, city and breaking news, and business. He works as well as a freelance writer for several national publications and as a consultant in communications and media relations/training. Mario was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list)

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience with over 120,000 downloads and thousands of subscribers on all our social channels and YouTube. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story.

Advertising and Sponsorships: At Canada’s Podcast we are here to help you reach your communication objectives and get you results. If you are looking to build your brand, promote your products/services, announce an event, then you will want to reach our extensive data base of owners and entrepreneurs.

Contact sales at: robert@canadaspodcast.com and find out how we can make an impact on your bottom line with our sponsorship packages. Sponsors include: RBC Bank, The Cooperators Insurance, Silicon Valley Bank, eBay, Lethbridge Economic Development, VanHack, CBC Dragon’s Den, The Competition Bureau, The Vancouver Board of Trade and more.