Lower-wage industries in Canada with more younger workers have been disproportionately impacted by the recent softening in labour demand, while higher-wage sectors have emerged as clear winners in a jobs market redefined by the pandemic, says a recent RBC report by Economist Claire Fan.

One silver lining in the Canadian labour market after the pandemic lockdowns was the strong demand for professional, scientific, and technical workers that allowed many well-educated and likely underutilized workers in the hospitality sector to make the jump to higher-paid work, wrote Fan.

Jobs in the professional services sector pay more than a third above the Canadian average and are more likely to be performed remotely such as legal services, accounting, engineering, design, advertising and scientific research and development, said the report

Claire Fan

“Hiring in hospitality sectors sharply lagged, because there simply weren’t enough workers available to fill jobs. Surging demand in higher-wage sectors meant fewer workers were available for jobs that paid less,” it said.

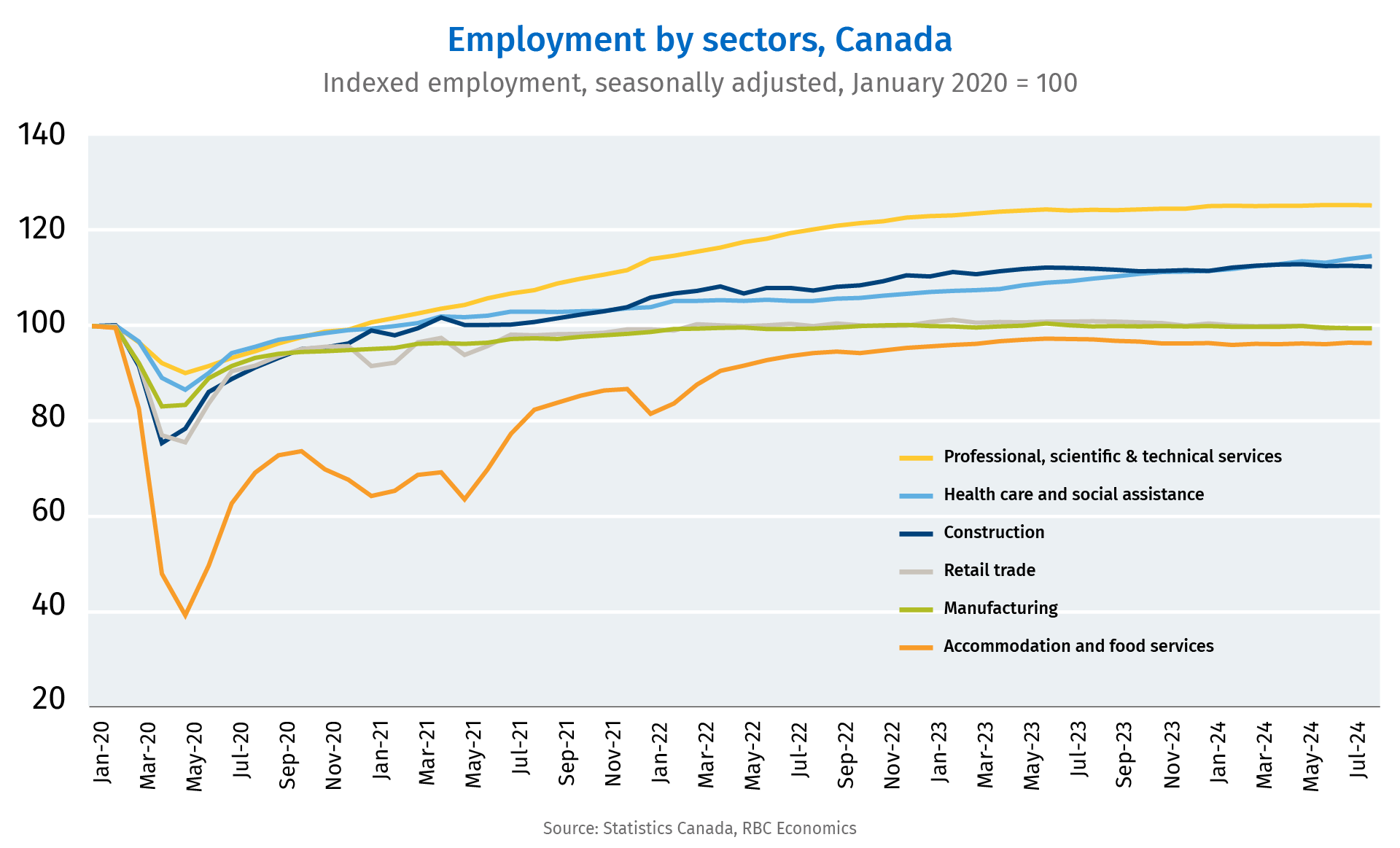

“But, that backdrop has now shifted. Lower wage industries such as accommodation and food services are still underperforming higher wage industries, but not because of a shortage of labour—there’s much softer hiring demand.”

Weak consumer spending costs jobs in related sectors

Over the past two years, rising interest rates have significantly cut into household purchasing power and lowered consumer demand. By our count, real spending on retail, restaurants and bars has each contracted by about 2% per person a year over the last two years, explained the report.

As a result, business hiring has significantly softened with job openings plunging below pre-pandemic levels. Retail, accommodation and food services combined lost more than 100,000 jobs since the summer of 2023, leaving employment in these sectors in October 6% below levels before the pandemic, said RBC.

The report said employment in professional, scientific, and technical services has continued to grow, with employment now around 23% above early 2020 levels.

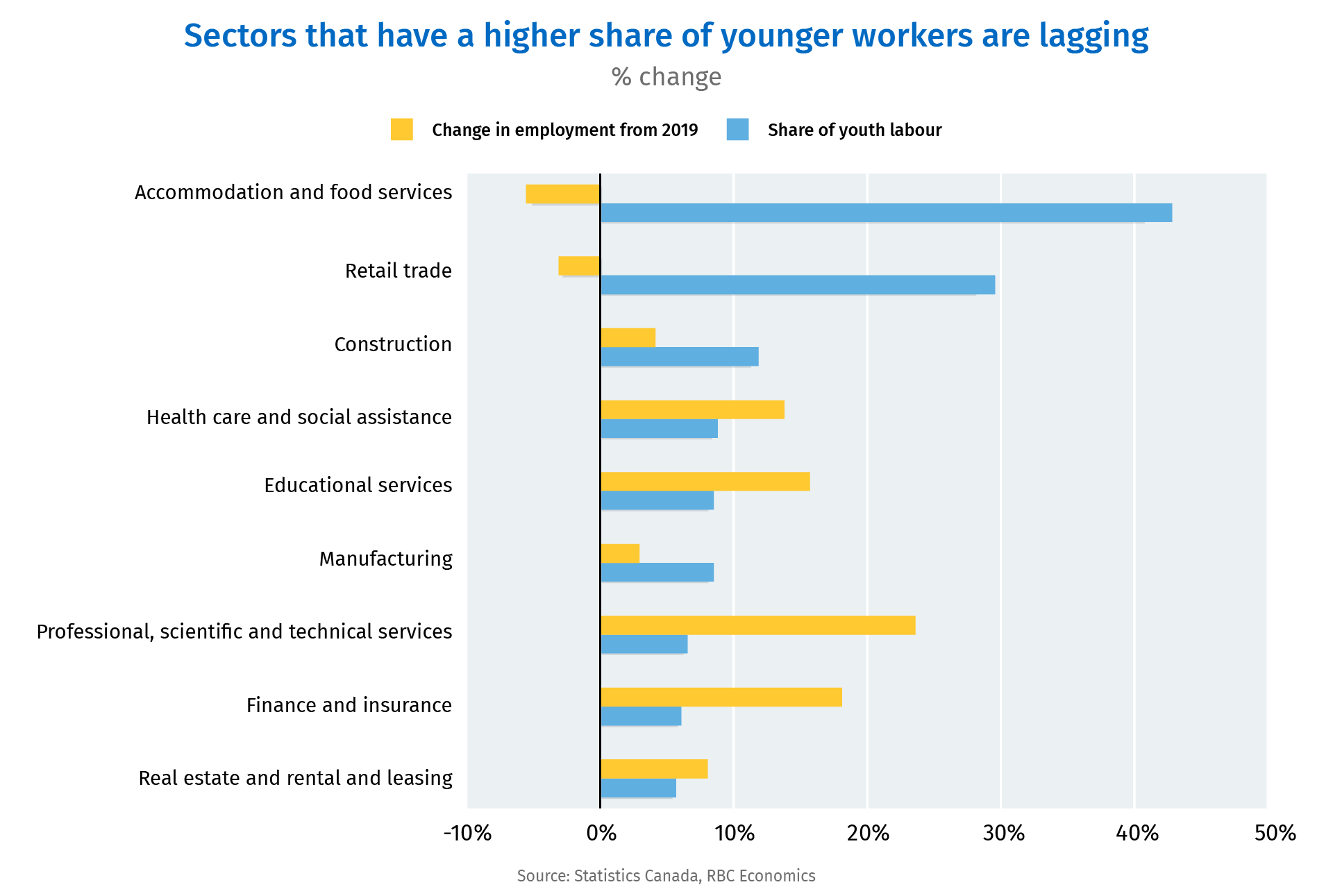

The larger pullback in employment among retail, accommodation and food services means much of the slowing in the labour market has impacted workers who tend to earn lower wages, and are often, younger, it added.

Younger workers more impacted

“By our count, around 30% of workers in retail and 40% of workers in accommodation and food services are aged between 15 and 24. These sectors have the highest share of youth employment—drastically higher than 13% across all sectors,” wrote Fan in the report.

“That explains why a disproportionately large share, close to 40% of the rise in the unemployment rate in Canada since the lows after the pandemic has come from workers aged 15 to 24. A big driver of this has been recent graduates being unable to find work.

“The good news for them is the Bank of Canada is now in an interest rate-cutting cycle. We expect broader consumer demand will start to look better. The bad news is monetary policy works with a lag. That means the recovery in hiring demand will come slowly. In the near term, it could still take younger workers longer than usual to find a balanced footing in the labour market.”

Mario Toneguzzi

Mario Toneguzzi is Managing Editor of Canada’s Podcast. He has more than 40 years of experience as a daily newspaper writer, columnist, and editor. He was named in 2021 as one of the Top 10 Business Journalists in the World by PR News – the only Canadian to make the list. He was also named by RETHINK to its global list of Top Retail Experts 2024.

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast.

With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience on all our social channels and YouTube – 500,000+ lifetime YouTube views, 200,000 + audio downloads, 35,000 + average monthly social impressions, 10,000 + engaged social followers and 35,000 newsletter subscribers. Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story