Canada’s provinces have enjoyed stunning revenue windfalls thanks to a sharp economic recovery, strong commodity markets and rising inflation that boosted both tax revenues and income from government business enterprises, says a report released Wednesday by RBC Economics.

“Alberta posted the biggest jump in revenue (+58.4%), and now boasts the largest surplus among provinces at nearly $4 billion in 2021-22. Nearly all other provinces are also reporting sizeable budget surpluses,” said the report.

“These upside revenues have led to significant downward revisions of provincial deficit projections. And they’ve come as a surprise, given early fears that the pandemic would create deep budget holes that would take years to climb out of. But the full effects of inflation have yet to ripple through to provincial balance sheets. Rising prices are driving up expenses—and are likely to eat into earlier gains in the coming quarters.

“The provinces have escaped their deficits with shocking speed. Though this has enabled them to avert the dire scenarios that were feared at the onset of the pandemic, a rougher road lies ahead. Prudence and judicious budget decisions will be necessary to tracking a sustainable fiscal path forward.”

Here’s the full report:

A (good) surprise: Canada’s provinces enjoy major revenue windfalls

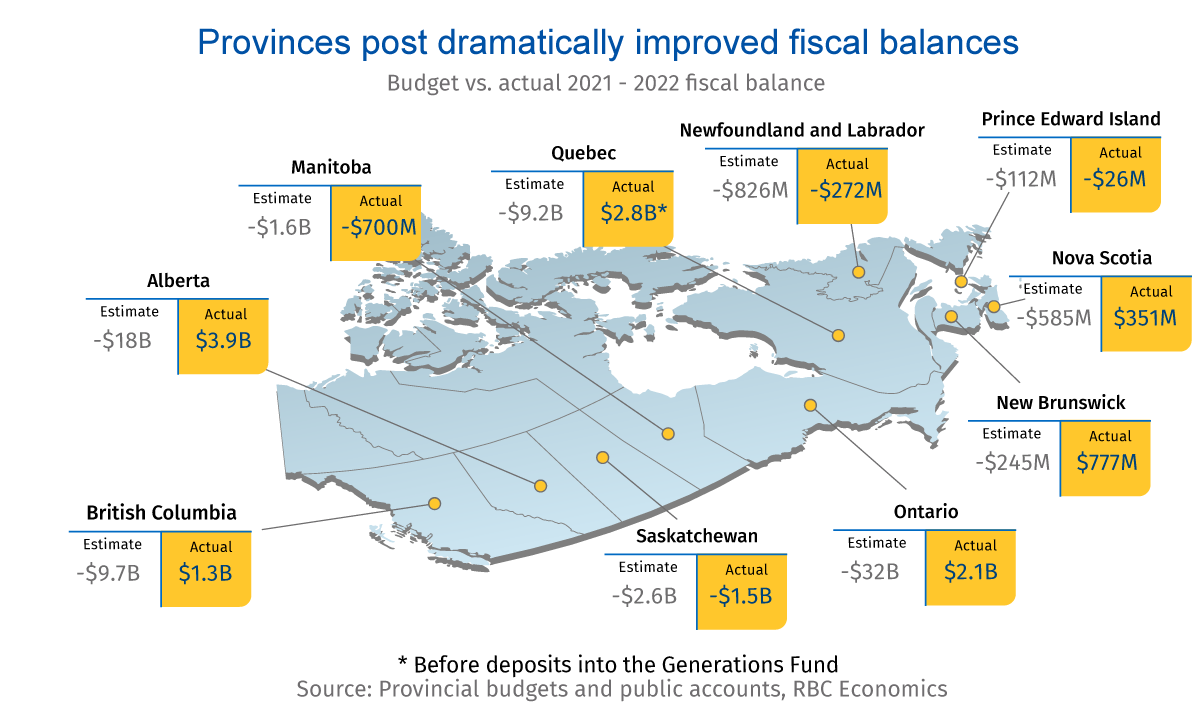

Following a record year of government spending to fight the pandemic, fears surrounding provincial finances have seemingly waned. From coast to coast, the lifting of COVID restrictions, stronger than anticipated economic rebounds, higher commodity prices and soaring inflation rapidly repaired early pandemic damage by fuelling a surge in revenues. The stunning windfall has resulted in massive downward revisions to large provincial deficit projections—with British Columbia, Alberta, Ontario, Quebec (before payments to the Generations Fund), New Brunswick, Nova Scotia, and P.E.I. all now reporting surpluses in 2021-22.

In the case of Alberta, revenues from non-renewable resources jumped nearly 500% from a budget estimate of $2.9 billion. This boom in proceeds is behind a dramatic reversal of fortunes for the province. After posting Canada’s largest provincial deficit in 2020-21 ($17 billion) and projecting another massive $18 billion shortfall in the 2021 budget, Alberta swung to the largest provincial surplus last fiscal year (nearly $4 billion) and recorded the largest jump in revenue (+58.4%).

Elsewhere in Canada, strong recoveries in business activity and labour markets led to much higher than expected corporate income tax and personal income tax revenues. Rising wages and salaries also likely contributed to some degree of tax bracket creep. This is particularly the case in Ontario, Alberta, and B.C., where year-over-year growth in wages and salaries were highest in the country. As solid consumer spending and rising inflation fueled sales tax revenues, most provinces saw revenue growth outpace increases in expenditures by a factor of two to one.

But surpluses will narrow as inflation bloats expenditures

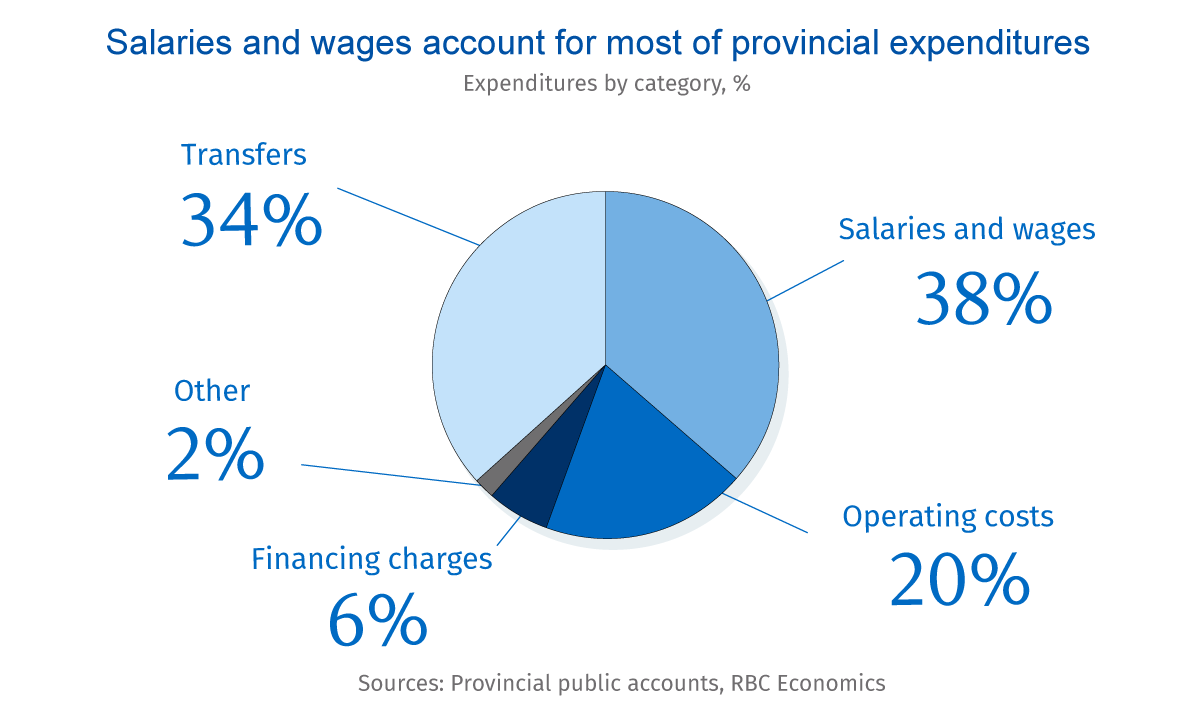

While inflation has evidently boosted government revenues, its effects have yet to be fully felt on the expenditure side of the ledger. With few items immune to cost pressures in the current economic environment, these effects are expected to be significant. Higher costs of living are poised to drive up public employee salaries which, in many provinces, represent over 30% of provincial expenditures. This could represent billions of dollars in additional spending. Other operating costs—for example goods and services bought by governments to provide services to Canadians—will also rise. And the Bank of Canada’s ongoing interest rate hikes to tame inflation will put upward pressure on debt charges.

Other spending pressures will emerge as Canada’s economy softens. For instance, given government transfers typically rise during times of economic turmoil, we’re likely to see this share of expenses increase during the upcoming recession.

The surprise provincial revenue gains that confounded early expectations will largely be sustained. But these new headwinds are gaining force.

Prudent fiscal policy will be key to tracking a sustainable path forward

The looming economic downturn, high inflation, and stiffer financing costs will soon tip the scale of provincial fiscal balances. As the Bank of Canada works to cool our economy, provincial governments will quickly be confronted with less favourable revenues and higher expenditures.

In this environment, prudent and deliberate fiscal policy will be key to tracking sustainable fiscal paths. Governments are particularly sensitive to rising interest rates in Newfoundland and Labrador, Ontario and Quebec, which have held the highest levels of debt-to-GDP since 2019. Though Ontario’s debt-to-GDP load (39.2%) and Quebec’s (38%) have improved since last year, Newfoundland’s is still the highest in the country at 43.8%. Judicious spending will be especially important in these provinces.

About Us

Canada’s Podcast is the number one podcast in Canada for entrepreneurs and business owners. Established in 2016, the podcast network has interviewed over 600 Canadian entrepreneurs from coast-to-coast. With hosts in each province, entrepreneurs have a local and national format to tell their stories, talk about their journey and provide inspiration for anyone starting their entrepreneurial journey and well- established founders.

The commitment to a grass roots approach has built a loyal audience with over 120,000 downloads and thousands of subscribers on all our social channels and YouTube.

Canada’s Podcast is proud to provide a local, national and international presence for Canadian entrepreneurs to build their brand and tell their story.

Advertising and Sponsorships:

At Canada’s Podcast we are here to help you reach your communication objectives and get you results. If you are looking to build your brand, promote your products/services, announce an event, then you will want to reach our extensive data base of owners and entrepreneurs. Contact sales at: robert@canadaspodcast.com and find out how we can make an impact on your bottom line with our sponsorship packages.

Sponsors include: RBC Bank, The Cooperators Insurance, Silicon Valley Bank, eBay, Lethbridge Economic Development, VanHack, CBC Dragon’s Den, The Competition Bureau, The Vancouver Board of Trade and more.